by IEA, via Energy Post

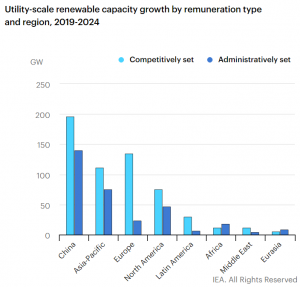

Government support for new utility-scale capacity is being replaced with competitive auctions, the surest sign that the commercial appetite for renewables – particularly solar PV and onshore wind – is growing strong. This article by the IEA pulls out the essential numbers from their annual Renewables 2019 report (their 5-year market analysis and forecast for renewable energy and technologies in the electricity, heat and transport sectors). The IEA says that by 2024 over two-thirds of utility-scale renewable additions will be competitive. Last year they predicted it would be half, so the upward trend is clear. Most of that change is driven from faster progress than expected in China. Solar and onshore wind lead, though hydro, offshore wind, bioenergy and geothermal will still see continued dependence on government-set tariffs. The other positive sign is that wind and solar PV contracts are getting shorter (i.e. the revenue protection provided by long term contracts is declining in importance) where electricity markets are partially or fully liberalised and competitive financing exists, such as North America and Europe.

For utility-scale renewable electricity technologies, many countries are transitioning from support schemes based on administratively set tariffs to competitive auctions for long-term power purchase agreements (PPAs). If they are well designed, auctions create a beneficial situation for both governments and developers.

For many governments, competition results in price reductions throughout the supply chain and lower total subsidy costs for renewables. For developers, PPAs provide long-term revenue certainty, which reduces project risks for capital-intensive renewable technologies such as wind and solar photovoltaic (PV). Read More